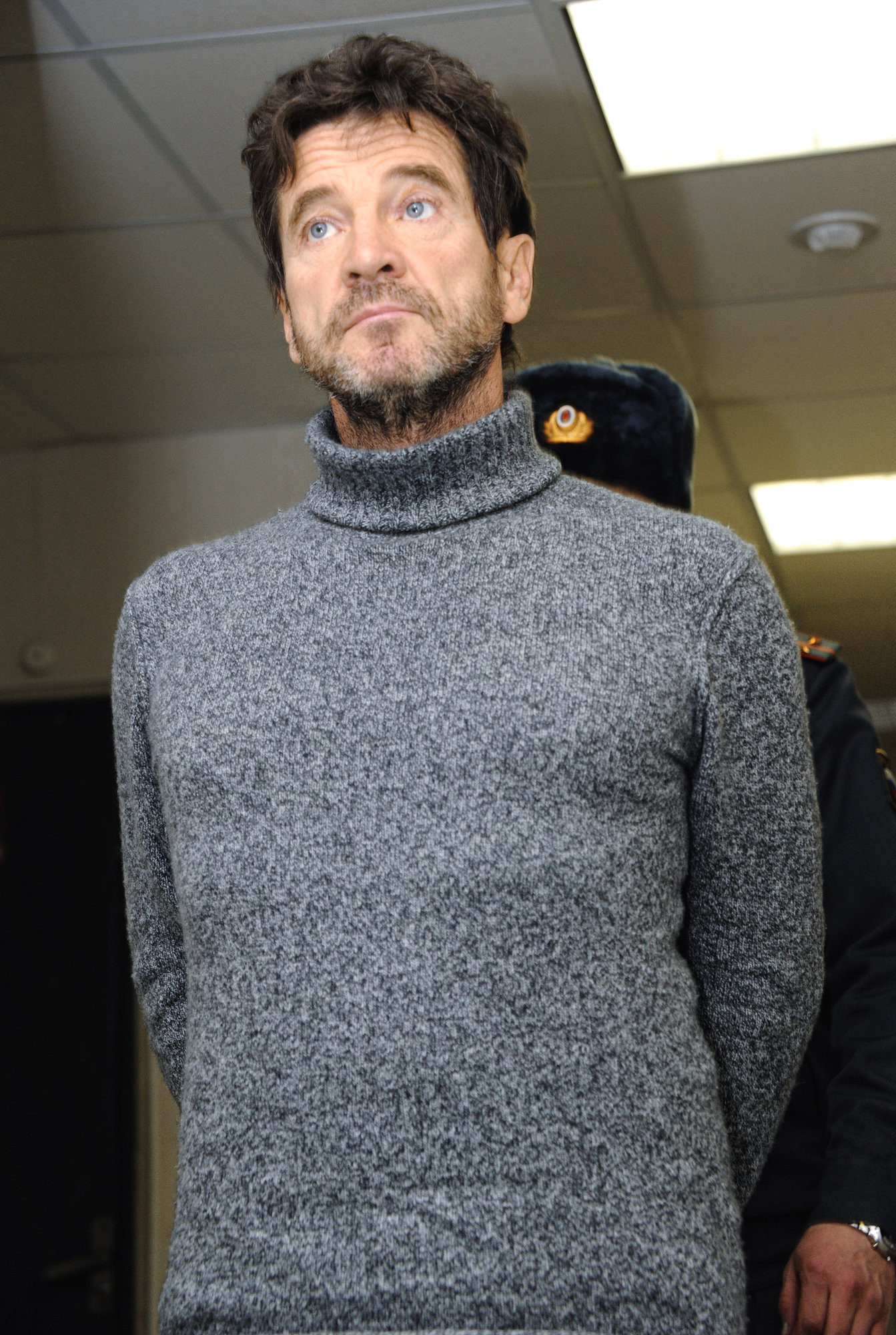

MOSCOW, May 12 - RAPSI. The Moscow Commercial Court postponed until May 15 the preliminary hearings of the lawsuit by Novolipetsk Steel to recover $178.75 million from Maxi-Group founder Nikolai Maximov, the court told the Russian Legal Information Agency (RAPSI/rapsinews.com).

In December 2007, the Novolipetsk Steel (NLMK) acquired a 50 percent plus one share in the Maxi-Group, which integrated companies ranging from scrap processing to steel production. The acquisition was based on an agreement that did not stipulate the fixed price of the stake. The final calculation was postponed until the completion of a financial and legal inspection of Maxi-Group's companies. Maximov was granted an advance payment worth around 7.3 billion rubles ($242 million).

In the end, the disagreements between the parties regarding the transaction amount led to legal disputes.

On Friday, the court considered Maximov's application to merge the dispute with another lawsuit against Maximov and Maxi-Group, in which NLMK requires the return of 7.3 billion rubles ($242 million) and requests the court to invalidate the agreement on the sale of shares.

NLMK does not object to the merger of cases, but is concerned over which judge will be hearing the dispute; NLMK believes that the hearing must go on as part of the case for the recovery of 5.3 billion rubles ($175.7 million).

The parties have not yet made joint calculations, with each party making their own separate calculations. According to its own calculation, NLMK has asked the court to return the overpayment contracted.

In a previous statement, NLMK stated that the transaction was conducted under false pretenses because Maximov did not provide accurate data on the amount of external financial debt and the possibility of the group's bankruptcy. He asserts that the company was insolvent during the time the agreement was concluded.

NLMK is one of the world's largest steel producers. The company is held primarily by Vladimir Lisin, with an 84.6 percent stake. Some 2.5 percent of the shares belong to the company's management. Another 12.89 percent of the company's shares are in free float, with 8.45 percent being GDR shares floating on the London Stock Exchange.