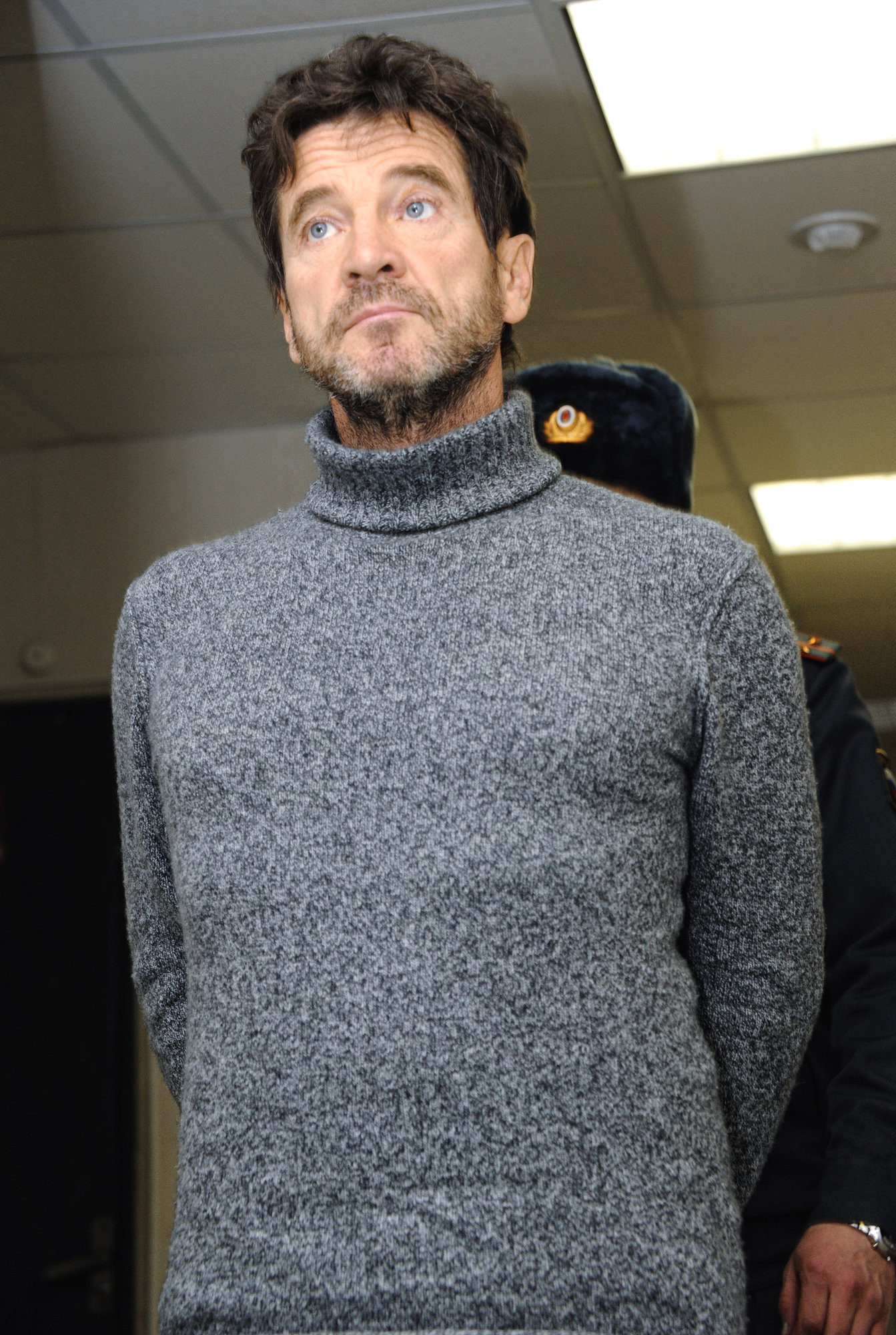

MOSCOW, June 29 - RAPSI. The Moscow Commercial Court has postponed until August 10 the preliminary hearings into two Novolipetsky Steel (NLMK) lawsuits to recover $166.84 million from Maxi-Group founder Nikolai Maximov. The lawsuits also seek to invalidate a sale and purchase agreement of Maxi-Group shares and to recover $225.88 million.

Earlier, the plaintiff's representative and the defendant requested an expert organization to submit the cost and the terms of the financial assessment to define the value of Maxi-Group shares as of December 3, 2007.

NLMK asked the court to levy execution on Maxi-Group under the $225.88 million lawsuit if the transaction is invalidated. The company also requested that the court transfer the funds to the state budget as opposed to Maximov.

Additionally, NLMK seeks to recover actual damages from the transaction worth 61 million rubles ($1.88 million). Maxi-Group has been attracted as a co-defendant to the case.

In one lawsuit, NLMK seeks 5.392 billion rubles ($166.84 million) from Maximov. In the second lawsuit, the company seeks to invalidate the Maxi-Group shares sale and purchase contract and to recoup the 7.3 billion rubles ($225.88 million) that NLMK paid to the firm.

The court proceedings began after December 2007 when NLMK acquired a 50 percent plus one share stake in Maxi-Group, which comprised various businesses.

Both parties later filed lawsuits regarding the deal price.

The share price was to be calculated after a financial assessment of Maxi-Group companies. Maximov was given an advance payment of 7.3 billion rubles ($225.88 million).

The parties have not yet made any joint calculations.

All of their estimates have been prepared separately. In a previous statement, Maximov said the portfolio that he sold was worth 23 billion rubles ($711.7 million).

At the same time, NLMK said the company was misled by Maximov, as he withheld information about Maxi-Group's debt and looming bankruptcy.

The company said Maxi-Group was insolvent at the time of the purchase.

NLMK is one of the world's largest steel producers.

Lisin is its primary beneficiary with a 84.6 percent stake in the company. Some 2.5 percent of the shares belong to the company's management. Another 12.89 percent of the shares are in free float, with 8.45 percent of them being GDR shares floating on the London Stock Exchange.